Modifications in our Medical Marijuana Industry That Business Users Need to find out About In Tax Time

Even although federal laws and regulations remain unchanged at tax time dispensary owners, growers, medible makers and everyone else within the spots with a state-legal medical marijuana market should be mindful of these modifications at tax moment.

By law anybody who produces $1 worth of business income must file a tax come back with the RATES. That is when they get to subtract their business breaks. Marijuana entrepreneurs are zero exception. If your state has repealed health care prohibition, is it doesn’t politician’s job to get unjust federal laws transformed for their inhabitants and businesses.

A change in those federal laws would preserve American taxpayers a lot more than $13 billion every year. Time has tested marijuana is not necessarily a gateway medication, nor would it lead to madness as movie producers once mentioned it did in order to thrill their audiences. And if smoking cigarettes a medicine could be the problem, medical users where dispensaries can be found have realized these people can also vaporize, eat medibles, sip juice or additional beverages, use tinctures, pills or termes conseillés. Public consumption is down where medical related marijuana clubs usually are available.

Every other small or good sized business is granted deductions when these people do their IRS federal return. In the states exactly where marijuana is legal for medical uses there are organizations that deserve to be treated pretty. There are twenty-three states and typically the District of Columbia this description now allow health care marijuana; those claims collect taxes (or anticipate collecting taxes) and set control inside of place for your prescribed holder.

Before America’s state-legal marijuana entrepreneurs and women can easily compete fairly all those federal laws should be repealed. A brand new federal ruling made in a San Francisco federal the courtroom blocks the DEA from prosecuting health care marijuana dispensaries credit rating state-sanctioned. The Rohrabacher-Farr Amendment bars typically the Department of Rights (DOJ) from using federal funds to block condition marijuana laws. This kind of 1603-page federal spending report essentially provides an end to the use of the particular taxpayer’s money to be able to block marijuana’s health-related use.

Where healthcare marijuana is offered legally, sustainable health-related is up and overdoses on prescription capsules is down. Pot has been claimed to be a very antibiotic, good intended for strokes and other brain problems, useful to alleviate soreness, nausea, Parkinson, other bowel disease, PTSD, epilepsy and some other seizures, kill tumor and Forbes journal even asked in case your aging parent should try this.

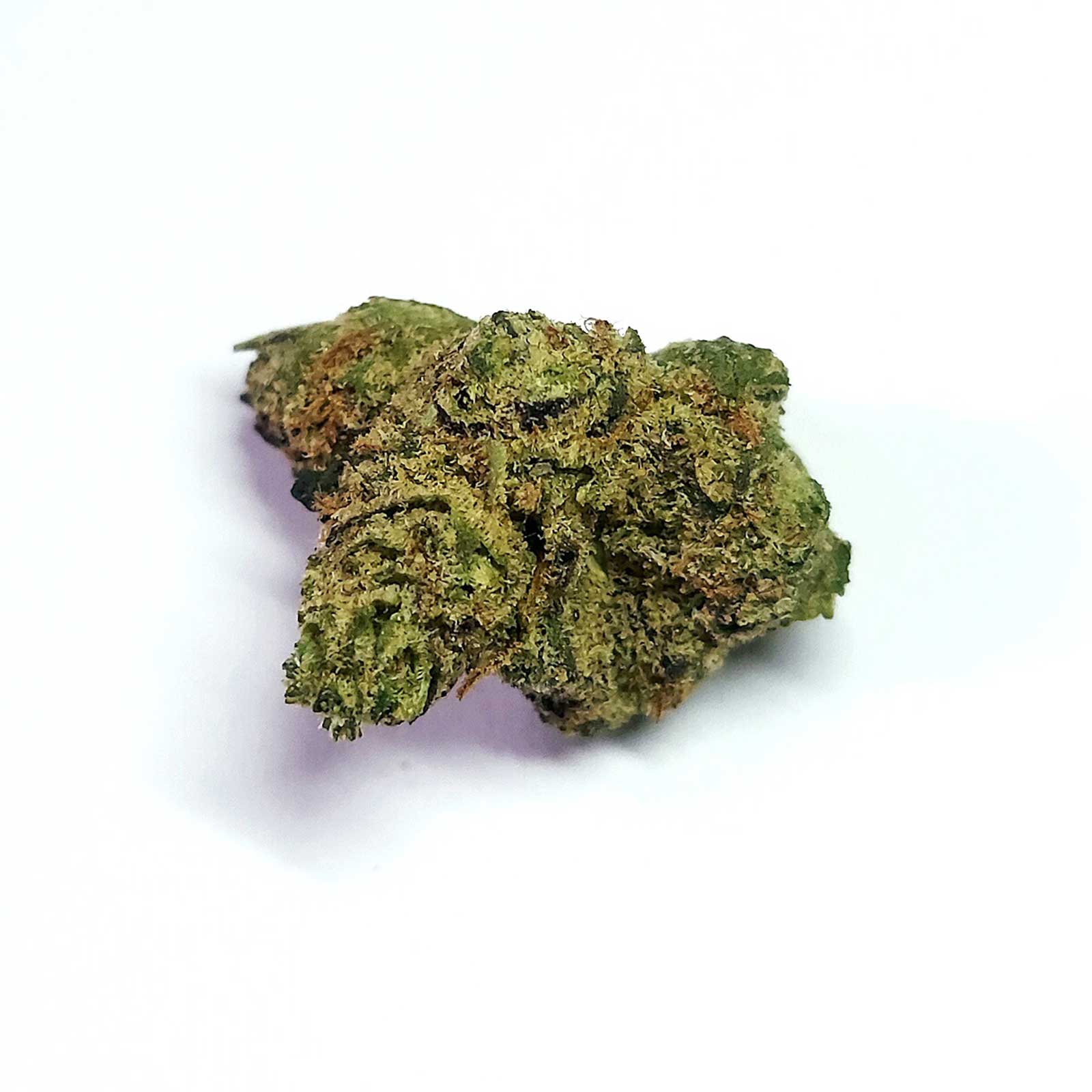

Dr. Sanjay Gupta has said we should legalize health-related marijuana now. This particular a plant that was once listed in the U. S i9000. Pharmacopeia and readily available in drug shops. With its employ people have walked out there of hospices and hospitals to live on satiety lives. The U. S authorities features even owned patent #6630507 since 2003 for its make use of as an antioxidant and neuroprotectant.

The DOJ issued a memo that permits Indian tribes to grow and market marijuana on their land. spritzer strain and people may also be rushing to end its medical prohibition; for example Israel makes use of marijuana in their very own hospitals as well as for analysis. Many senators in addition to governors need it legalized for medical work with once again.

The IRS Advisory Signal Report says weed businesses are at this point legal in quite a few states, however illegal under federal legislation. Marijuana web based not necessarily allowed to deduct all of their expenses since the national government says no deduction or credit score shall be permitted for any amount paid out or incurred if such trade or perhaps business (or the particular activities of the trade or business) contains trafficking within a controlled substance. Marijuana according to national laws is actually a handled substance with no medical use; yet the government government holds the patent for health care use.

Those who else desire to keep healthcare marijuana illegal will be mostly getting rich off of that being an unlawful substance, although numerous pay no taxation on the funds they earn. This includes the damaged, illegal growers, dealers, trimmers and medible makers, people obtaining taxpayer assistance bank checks but doing work in this specific trade, and others who else want to retain marijuana on the black market. These people don’t care the particular citizens want, that they voted, or whether or not it helps some sort of person’s sickness, since long as these people make money.

Healthcare marijuana users and even business owners in the us where the people have voted in order to make marijuana’s make use of legal yet again have to have to have standard meetings with their state politicians in order to discuss the unfounded taxation problems. The folks have spoken, now it’s the politician’s turn to get individuals laws changed.